Video KYC: fast & simple customer verification for fintech

Discover how fintech companies streamline customer onboarding with SnapCall’s Video KYC solutions. Fast ID verification through live video, AI bots, or recorded clips—secure, compliant, and user-friendly.

Table of contents

What is video KYC for fintech?

How does video KYC verification work?

Video KYC success story: Casino team's 80% faster onboarding

Why fintech companies are adopting video KYC

Benefits of using video KYC for your fintech business

FAQs about video KYC verification

What is video KYC for fintech?

Ever had to verify your identity online? If you nodded your head (and maybe rolled your eyes), you know the drill—taking awkward selfies, scanning IDs, and then crossing your fingers that everything goes smoothly. Honestly, it can be a huge pain, right? But guess what? Video KYC for fintech is here to make all of this a lot less frustrating.

Video KYC verification means confirming someone's identity using video calls instead of traditional methods like in-person visits or clunky document uploads. Think FaceTime meets compliance for fintech businesses. Pretty neat, huh?

Instead of uploading endless scans and hoping for the best, customers jump on a quick video call or submit a short video clip. And thanks to solutions like SnapCall, fintech companies can handle these verifications faster, smoother, and—let’s be real—way more enjoyably.

How does video KYC verification work?

Let's break it down into a few easy steps:

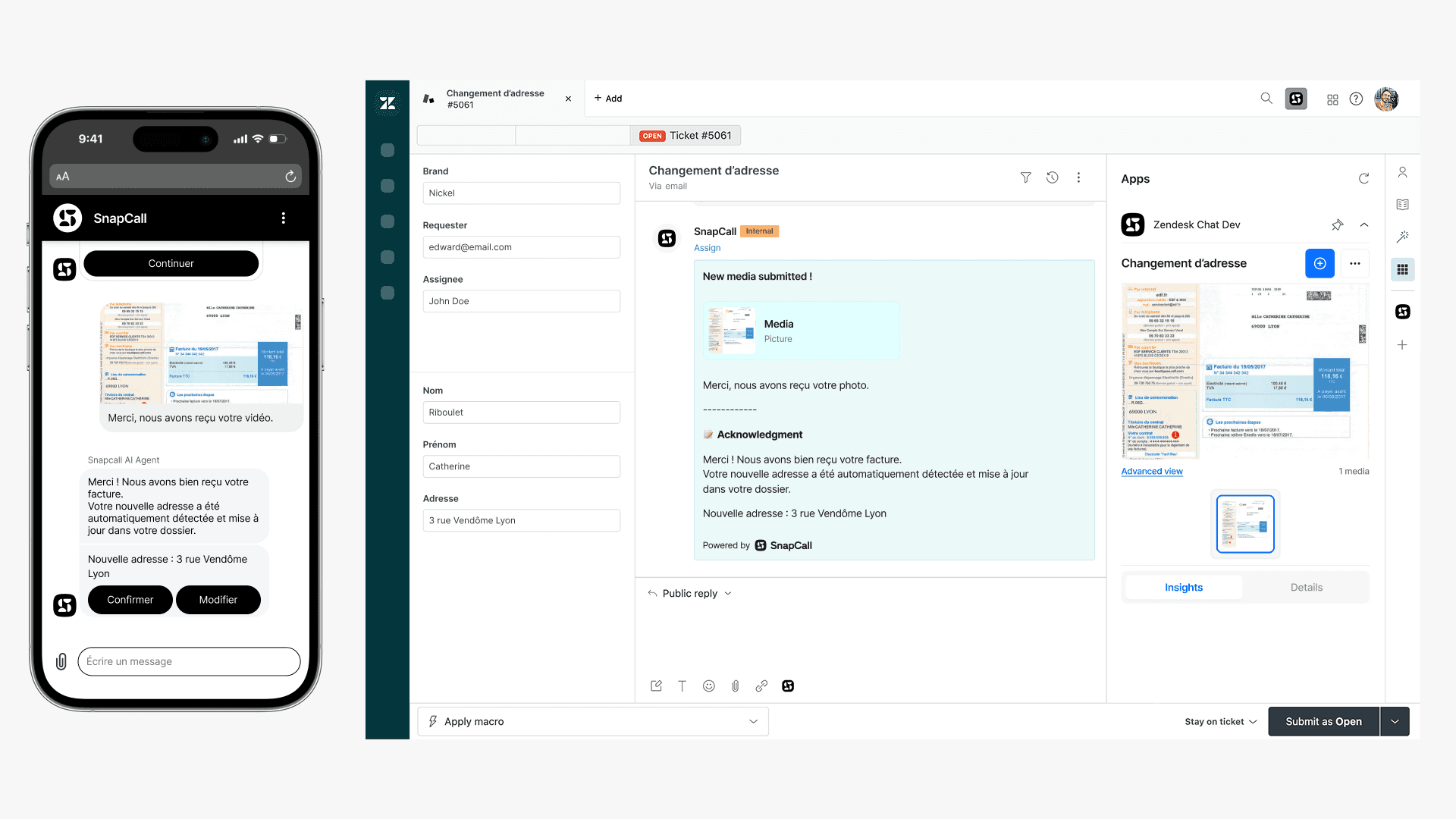

Kick off the verification: Customers choose how they'd like to verify their identity. Want a quick live call? Perfect. Prefer recording a short video at 2 AM in your pajamas? Also perfect. Or maybe you're cool with letting a smart AI-powered bot handle it. SnapCall lets fintech businesses offer all these options seamlessly, right inside apps or websites like Zendesk or Salesforce.

Check and confirm: Here’s where the tech magic happens. SnapCall's intelligent systems automatically extract key information from the ID provided. The AI compares faces in real-time to ensure the person on-screen matches the ID. Usually, bots handle straightforward cases, with humans stepping in only when something seems off. All checks get timestamped and securely stored, keeping everything transparent and compliant.

Sort out issues immediately: What happens if something isn't quite right? Instead of sending confusing emails back and forth, issues get sorted out on the spot. Support teams can visually pinpoint exactly what needs fixing, saving everyone time. And if customers need another go? Re-checks are effortless, quick, and honestly, pretty stress-free.

Video KYC success story: Casino team's 80% faster onboarding

Look, don't just take our word for it. A well-known casino platform using SnapCall saw their video KYC verification get 80% faster. Imagine going from hours to minutes—sounds dreamy, right? They're now handling over 21,000 verifications each month, with customer satisfaction up 30%. One-size-fits-all rarely works, and SnapCall gives customers the freedom to choose their verification style. It turns out people really like having choices—who knew?

Why fintech companies are adopting video KYC

Banks love video KYC because customers can verify themselves anytime—weekends, nights, or whenever their favorite show finishes. Phone companies are letting bots handle routine checks, saving their agents hours daily. Even insurance companies are embracing video clips as a comfortable alternative to traditional face-to-face meetings.

You see, fintech and other businesses across industries are discovering something crucial: happier customers make life easier for everyone.

Benefits of using video KYC for your fintech business

If you're a fintech company, your business hinges on trust, speed, and convenience. Let's face it—your customers don't want to wrestle with verification hurdles. They just want to start using your services ASAP.

With SnapCall’s video KYC verification, customers verify on their terms. That means fewer drop-offs, faster onboarding, and happier folks at the end of the day. Plus, video checks catch fraudsters way better than static photo uploads (goodbye, fake IDs!).

FAQs about video KYC verification

What is video KYC verification?

Video KYC verification is the process of confirming customer identities through video calls or short clips instead of traditional document uploads or face-to-face meetings.

Is video KYC secure for fintech?

Absolutely! All video KYC checks are secure, timestamped, and fully compliant with regulations, ensuring data privacy and safety.

Does video KYC comply with regulations?

Yes, video KYC meets regulatory requirements, and solutions like SnapCall ensure transparency and compliance.

How can fintech companies benefit from video KYC?

Fintech companies benefit by reducing verification time, increasing customer satisfaction, minimizing fraud, and providing seamless onboarding experiences.

Can video KYC integrate with Salesforce or Zendesk?

Yes! SnapCall integrates smoothly with platforms like Zendesk, Salesforce, and directly into your fintech company's website, making customer verification straightforward and convenient.